FINANCIAL SERVICES

Smarter Systems for a Faster Financial Future

Your customers expect instant answers. We help you deliver—with modern platforms, real-time data, and AI that drives both compliance and connection.

AI-powered financial services, built for trust and scale

We help financial institutions modernize legacy platforms, reduce complexity, and build intelligent systems that move fast—without compromising security, compliance, or customer trust.

Speed, trust, and intelligence now define the modern financial experience. Whether you’re a bank, credit union, insurer, or fintech leader, your customers expect more—instant answers, real-time insight, and intuitive experiences that simplify their lives. But behind the scenes, legacy tech and siloed data can stall innovation. At Robots & Pencils, we blend deep financial services experience with AI-first thinking, helping clients re-platform legacy systems, streamline operations, and build next-gen digital products. Our solutions scale with security and compliance in mind—so you can deliver with confidence and outpace slower-moving competitors.

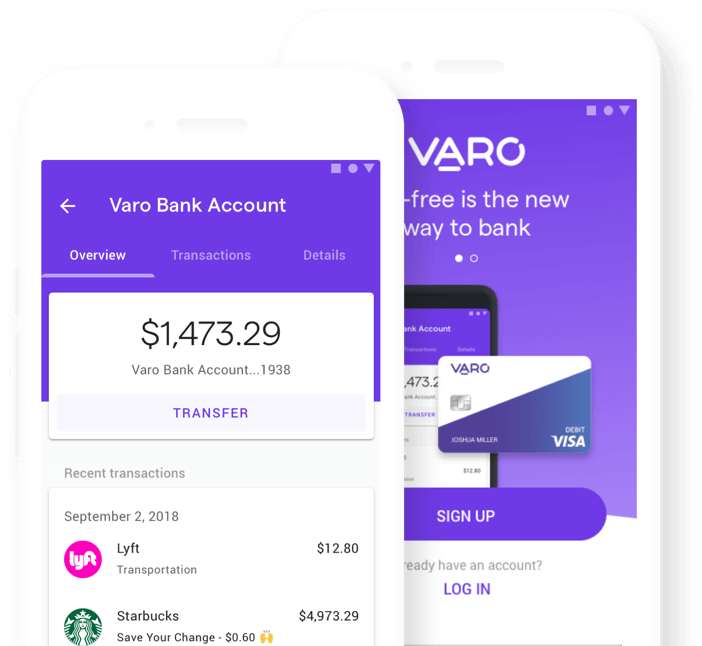

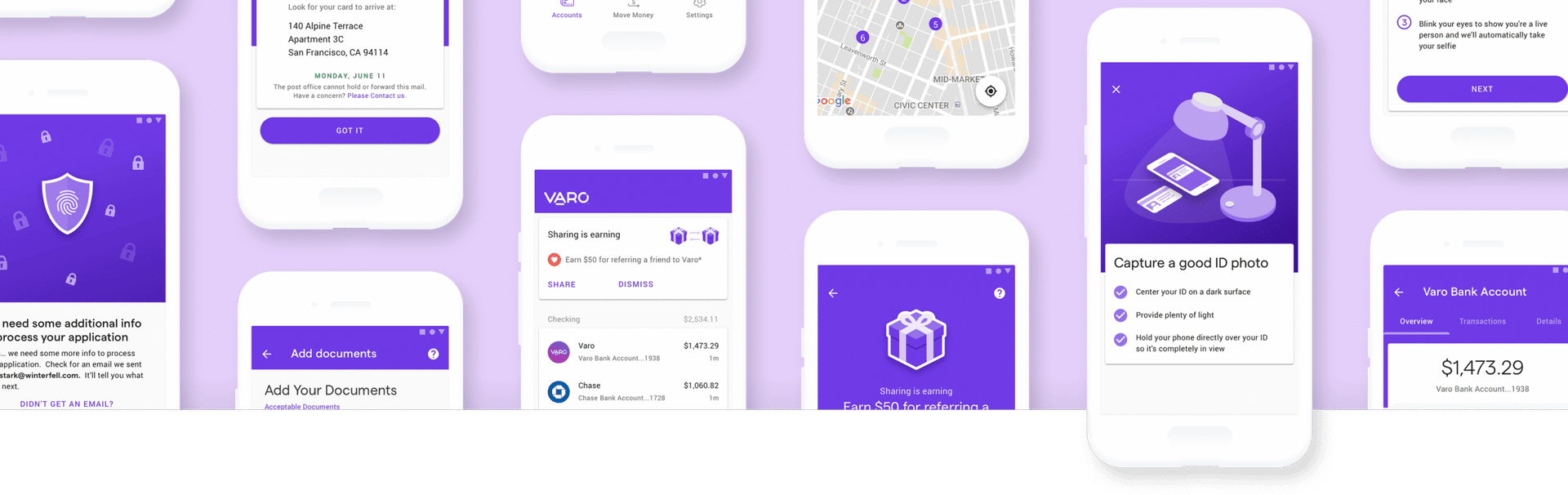

VARO

Mobile platform enables growth & ensures regulatory compliance.

Over 1 million customers and growing

22,000+ 5-star reviews on App Store and Google Play™

FinTech Innovation

Where We Drive Value

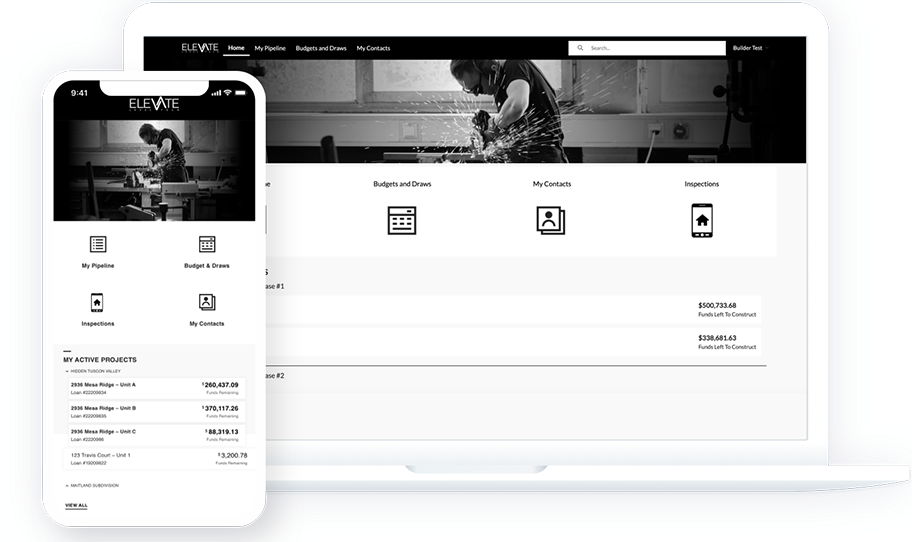

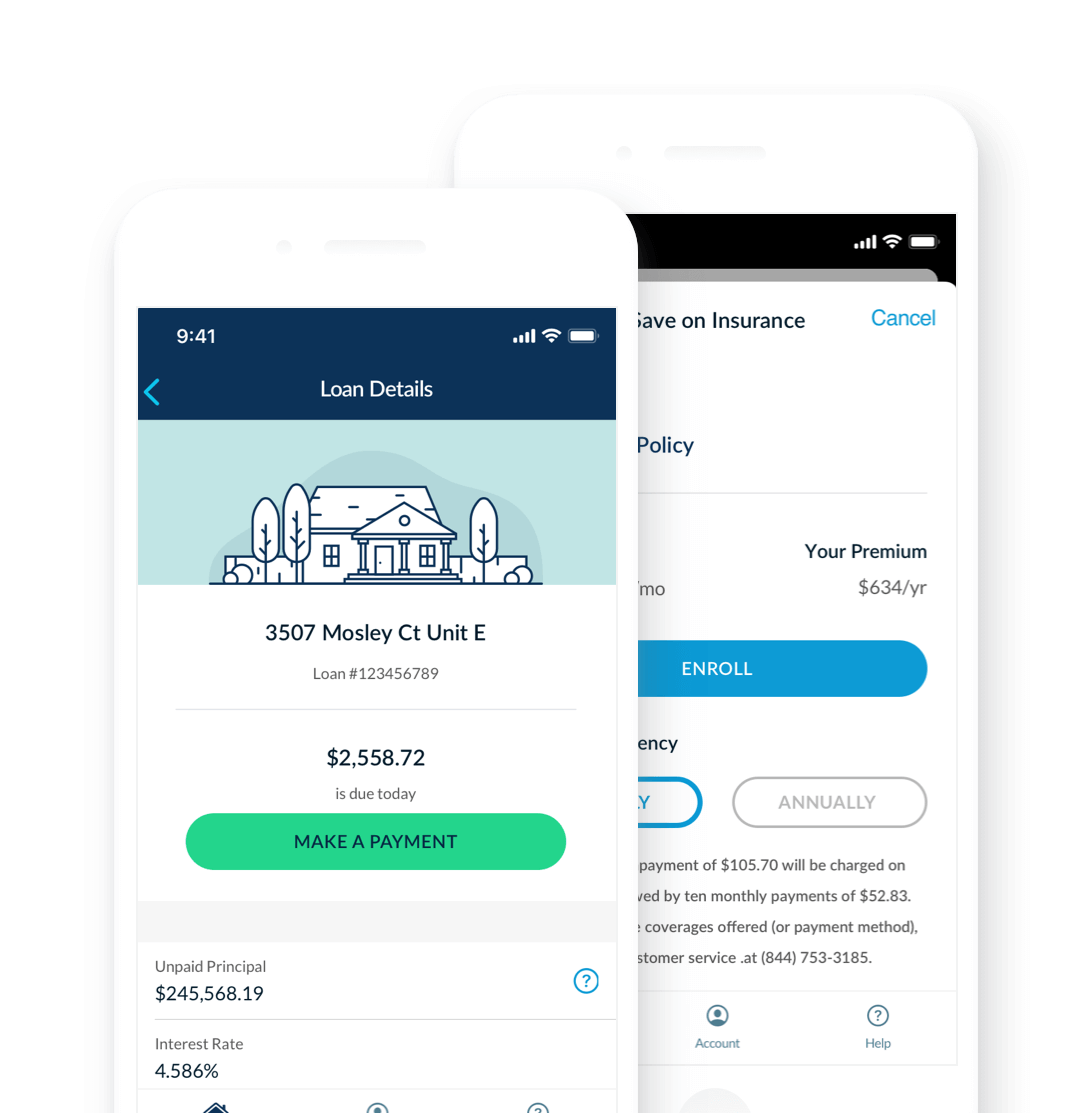

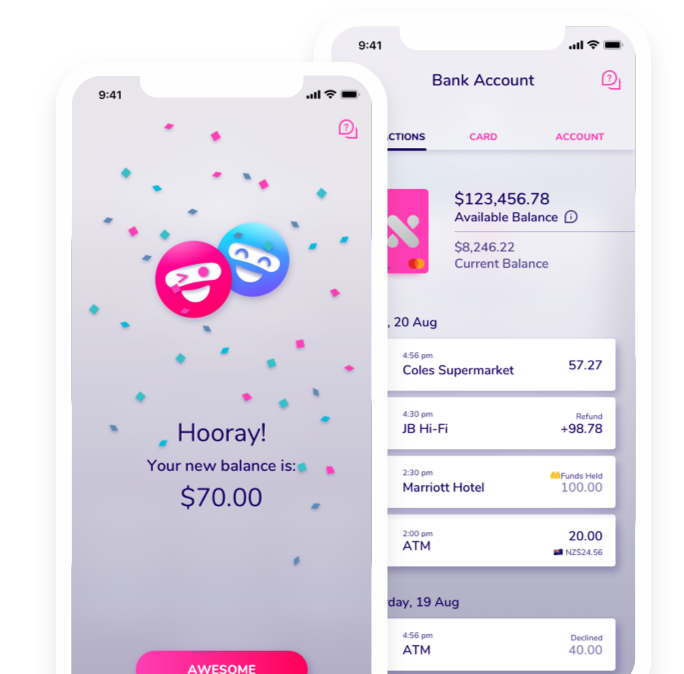

CASE STUDIES

Explore results from our forward-thinking financial services partners.

Let’s Build What’s Next in Financial Services

Bring us your toughest constraints—and your boldest vision. We’ll bring the engineering, design, and AI expertise to modernize legacy systems, unlock real-time insights, and build seamless, secure digital experiences.